The now-removed taxman, his family used stock market to mint tens of millions

Former NBR official Md Matiur Rahman, who became a subject of controversy thanks to a high-profile sacrificial goat, has made much of his wealth by minting pre-public shares, an analysis of his and his family’s shareholding in at least 15 publicly listed companies show.

Total shares held by Motiur and family members: 98,041,492

Pre-public shares, or placement shares, are those that are offered privately to individual investors, before a company goes public, or releases shares on the stock market for investment.

By its very nature, placement share trading requires a prior association between the company and the investor.

This becomes problematic when the investor in question is a tax regulator himself, holding various positions at NBR with the last being president of Customs, Excise and VAT Appellate Tribunal.

Millions of these placement shares were not just offered to him, but to a large number of his immediate and extended family members.

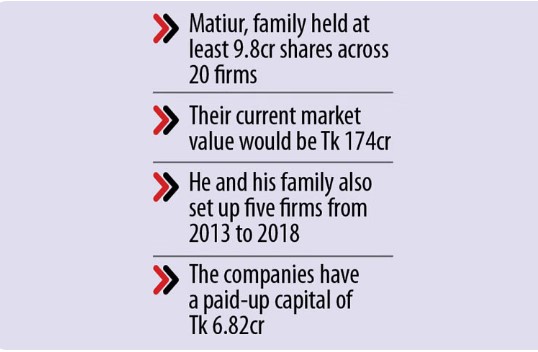

Over the last three weeks, The Daily Star tracked the pattern of their buying at least 9.8 crore placement shares across 15 companies before the companies went public.

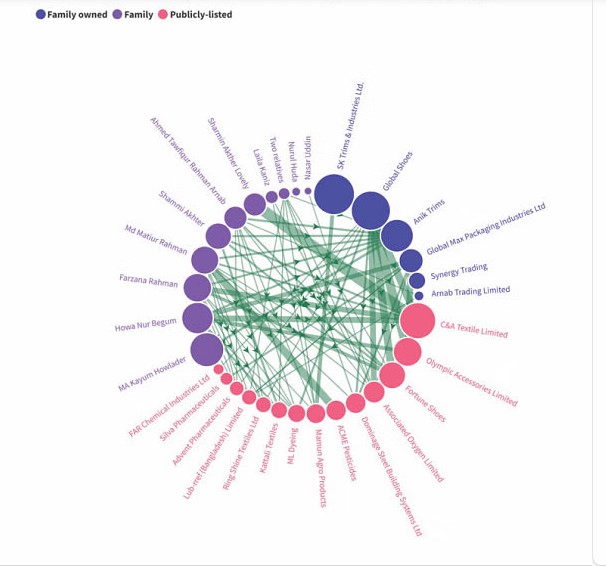

The shareholders include his immediate family: his first wife Laila Kaniz Lucky, his second wife Shammi Akter Shibli, his son and daughter from the first marriage Ahmed Towfiqur Rahman Arnab and Farjana Rahman Epshita.

The shareholders also include his sister Howa Nur Begum, his brothers MA Kayum Howlader and Md Nurul Huda, his sister-in-law Sharmin Akter Lovely, and his brother-in-law Mohammed Nasar Uddin. The Daily Star also tracked the shares of two of his relatives from his village, Md Rashiduzzaman and Md Mijanur Rahman.

Most of these shares — about 63.5 percent — were bought in their own names, while 36.5 percent of the shares were bought in the name of five companies owned wholly or partially by Matiur and his family members.

With a combined paid-up capital of Tk 6.82 crore, all the five family-owned companies were set up or acquired between 2013-2018 when Matiur held important positions in NBR, according to the company filings at Registrar of Joint Stock Company.

A significant portion of the placement shares were also bought during this period, although millions of such shares can be traced back to 2011, 2010, 2008, and even 2002.

Between June 24 and July 5, repeated attempts were made to contact Matiur Rahman, Howa Noor Begum, Sharmin Akhtar Lovely, and Farzana Rahman, but their phones were found switched off. Arnab, Laila Kaniz, and Kayum Howlader did not respond to our phones and text messages.

Service rules do not allow government officials to be involved in speculative trading. Service rules also do not permit any member of his family “to make any investment likely to embarrass or influence him in the discharge of his official duties.”

The rules also bar public officials from investing in any stocks about which he would have had information, which Matiur clearly had as a revenue official during these years. In other words, the placement shares he and his family members accepted before the companies released their IPOs was essentially insider trading, a violation of capital market rules.

Matiur and his family’s wealth made headlines after, Mushfiqur Rahman Ifat, reportedly his son from his second marriage, posted a photo of a sacrificial goat on social media and claimed to have bought it for Tk 12 lakh. According to the owner of the farm where the goat was raised, Ifat eventually did not take the delivery in the face of the controversy, although he had made an advance of Tk 1 lakh.

Matiur publicly denied that Ifat was his son.

Assuming that the shares were bought at a face value of at least Tk 10, the cumulative purchase value of the shares held by Matiur and his family over the years is at least Tk 101.3 crore, according to our calculation based on publicly available data from the capital market.

These shares are spread across 15 publicly listed companies and five non-listed companies where he and his family members have significant ownership.

The current market value of the shares of the publicly listed companies would be about Tk 175 crore, although The Daily Star cannot confirm if they still hold all the shares or if they hold shares in any other companies.

The five privately owned companies are Global Shoes, Global Max, SK Trims, Anik Trims and Synergy Trading.

Matiur, who joined government service in trade cadre in 1994 and was transferred to customs in 1998 on deputation, is currently a first-class officer, with a monthly basic salary of Tk 78,000. In the wake of the recent development surrounding his and his family wealth, he has been removed from NBR and attached to the finance ministry.

His first wife, Laila Kaniz Lucky, retired as an associate professor from Government Titumir College in the capital four years ago. Her yearly pension is Tk 4.63 lakh.

Also chairman of Narsingdi’s Raipura upazila, Lucky’s tax files submitted to the Election Commission before this year’s upazila polls show she is worth Tk 10.31 crore, although a closer look by The Daily Star indicates she may have understated her wealth by dozens of times.

Their son Arnab is a 2021 graduate from the University of Michigan with a Bachelor in Arts, while his daughter Farjana is a makeup artist and runs a makeover business in Canada, according to the university website and Farjana’s Instagram profile.

Matiur’s brother MA Kayum Howlader owns or has owned the most shares among his immediate family members — 1.4 crore shares across three companies.

His sister Howa Nur Begum has had 1.15 crore shares in her name, spread across eight companies.

Matiur’s daughter Farjana Rahman Epshita, who now lives in Canada, has owned the third highest number of shares — 90.5 lakh across nine companies.

Matiur has owned 86.3 lakh shares across nine companies.

His second wife Shammi Akhter (Shibli) has owned 74 lakh shares across five companies while her sister Sharmin Akhter Lovely 52.5 lakh shares in one publicly listed company.

Matiur’s son Ahmed Tawfiqur Rahman Arnab has had 52.9 lakh shares in these 10 public companies. His first wife Laila Kaniz Lucky has had 9.1 lakh shares, while his second brother Md Nurul Huda 1.5 lakh shares. Matiur’s brother-in-law Md Nasar Uddin has had 60,000 shares.

In addition, two other relatives from his village home held 60,000 shares.

The 15 publicly listed companies include garment and garment accessories manufacturers like C&A Textiles Ltd, SK Trims & Industries Ltd, ML Dyeing, Olympic Accessories Ltd, Ring-Shine Textiles, Kattali Textiles; chemical and pharmaceutical companies like Associated Oxygen Ltd, Lub-rref (Bangladesh) Ltd, Silva Pharmaceuticals, FAR Chemical Industries Ltd, ACME Pesticides, Advent Pharmaceuticals, Mamun Agro Products and a steel builder named Dominage Steel.

“It is public knowledge that placement shares are given as favour. Why did so many companies favour him?” said former BSEC chairman Faruq Ahmed Siddiqi.

In addition to the stock market shares, this newspaper found 3.5 crore placement shares held by the companies owned by Matiur and his family members.

A shoe company called Global Shoes Ltd whose managing director is Matiur’s brother, MA Kayum Howlader, and whose shareholder is his brother-in-law Nasar Uddin was found to have owned placement shares in 10 of the same companies where Matiur and his family members have pre-IPO shares.

Global Shoes has held 1.96 crore shares in Matiur and his families’ private companies since long.

Another of their family-owned company named Global Max Packaging Industries Ltd has held 58.5 lakh shares in at least four companies as Matiur’s family members for over a decade. The managing director of Global Max was Matiur’s sister-in-law Sharmin Akhter Lovely. Its director was his brother-in-law Nasar Uddin, while the chairman is his sister Howa Nur Begum.

Three other such family-owned companies are Arnab Trading Ltd, SK Trims Ltd and Synergy Trading Ltd, which collectively hold 97.4 lakh placement shares in three publicly listed companies where Matiur’s family members also hold placement shares.

On more than one occasion, the placement shares were bought by these family-owned companies on the same day or adjacent dates.

For example, Global Shoes bought placement shares from ML Dyeing Ltd on May 2, 2010, the same day that Matiur Rahman, his son, his daughter, and his sister purchased placement shares in the company.

One of the companies, Ring-Shine Textiles, in which Matiur, his son, his daughter and their company Global Shoes own placement shares, was accused of disbursing placement shares but not taking any cash in return.

Ring-Shine had raised its paid-up capital from Tk 9.95 crore to Tk 285 crore allegedly by issuing placement shares before opening to the public in 2019. Bangladesh Securities Exchange Commission later found that 11 sponsor directors and 33 external shareholders were given the shares for free.

Matiur and his family got 17.5 lakh placement shares from Ring-Shine in October 2008.

“Why was no action taken against them and their shareholders for such a crime?” questioned former BSEC chairman Faruq Ahmed Siddiqi.

Matiur told an interview with a private television on June 19 that he would sit with owners of listed companies and visit firms to identify their weaknesses and offer solutions for growth, and took placement shares in exchange. He offered consultancy for initial public offerings (IPOs) to help companies float shares to raise money from the public.

He also said that in exchange for his “consultancy,” he got shares of Fortune Shoes at a discount rate of Tk 8 (as opposed to the face value of Tk 10 per share), which is a violation of the law.

“As a government servant, he has violated government rules. He cannot provide such consultancy. They should take action against such misconducts,” said Faruq.

However, Matiur committed a graver crime, he added. “He knew insider information. It is a crime to trade when you have such critical inside information. This is insider trading.”

Source: The Daily Star, Dhaka.