Dhaka stocks fall for 2nd day

Share prices of 201 out of the 392 listed companies and mutual funds were stuck in their floor prices on Wednesday as 27 more companies and MFs were added to the list on the day.

Market experts said the floor price system which the Bangladesh Securities and Exchange Commission introduced in July 2022 narrowed the access and exit options for investors that restricted natural growth of the market.

The commission had initially imposed the floor price restriction on all companies to prevent any excessive fall in stock prices amid economic worries in the country.

The regulator had later lifted the restriction on 169 companies and imposed a 1-per cent downward circuit breaker on them.

On March 1, the commission reinstated the floor price barrier on those companies.

Former BSEC chairman Faruq Ahmed Siddique said that the market had been managing an artificial index for the past seven months.

Though the turnover and the share prices of a number of low-profile companies rose and fell in the period, the floor price restriction impacted negatively on the share price growth of good performing companies, he said.

Investors were unable to sell their shares due to the poor regulation and so a huge amount of money invested by the large-scale investors got stuck, he said.

Liquidity crisis on the money market also forced the investors to remain on the sideline, he said.

‘If the situation remains the same, the foreign investors will lose their interest to invest in the country’s stock market,’ he said.

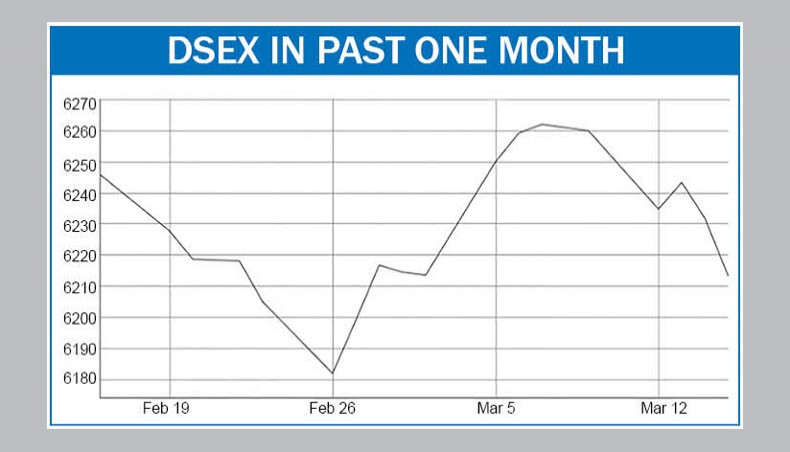

Dhaka stocks on Wednesday extended the losing streak to the second trading session as investors went for selling shares.

DSEX, the key index of the Dhaka Stock Exchange, lost 18.58 points, or 0.29 per cent, and settled at 6,213.37 points on Wednesday against 11.61 points on Tuesday.

The DSEX closed in the negative zone on Wednesday as investors sold shares to book some profits amid the economic woes in the country, market operators said.

Multiple macroeconomic challenges, including inflation, rising external debts, foreign exchange market volatility, depleted foreign reserves, and a growing trade deficit and energy crisis forced most of the investors to remain on the sideline, they said.

Out of the 306 issues traded, 21 advanced, 110 declined, and 175 remained unchanged on the day.

The turnover on the DSE increased to Tk 607.16 crore on Wednesday from that of Tk 563.63 crore on Tuesday.

Olympic Industries, Al-Haj Textile, Padma Life Insurance, Chartered Life Insurance, ADN Telecom, Sonali Life Insurance, Rangpur Dairy, Premier Bank, Oimex Electrode, and Navana CNG were the top 10 gainers considering their closing prices on the day.

Metro Spinning, Bangladesh General Insurance, Union Capital, Monno Agro, Sena Kalyan Insurance, Rupali Life Insurance, Meghna Pet, Sea Pearl Beach Resort and Spa, Zeal Bangla Sugar, and Meghna Condensed Milk were the top 10 losers considering their closing prices on the day.

Life insurance, food and allied, bank, and engineering sectors exhibited the highest positive returns on the day.

The DS30 index also decreased by 2.49 points to finish at 2,215.17 points and the DSE Shariah index lost 1.49 points to close at 1,353.72 points on the day.

Meghna Life Insurance topped the turnover chart with its shares worth Tk 50.27 crore changing hands.

Olympic Industries, Rupali Life Insurance, ADN Telecom, Aamra Networks, Genex Infosys, Sea Pearl Beach Resort and Spa, BDCOM Online, Sonali Life Insurance, and Bengal Windsor were the other turnover leaders on the day.

Source: The New Age, a Dhaka based Newspaper.